Condo Insurance in and around Chicago

Chicago! Look no further for condo insurance

Protect your condo the smart way

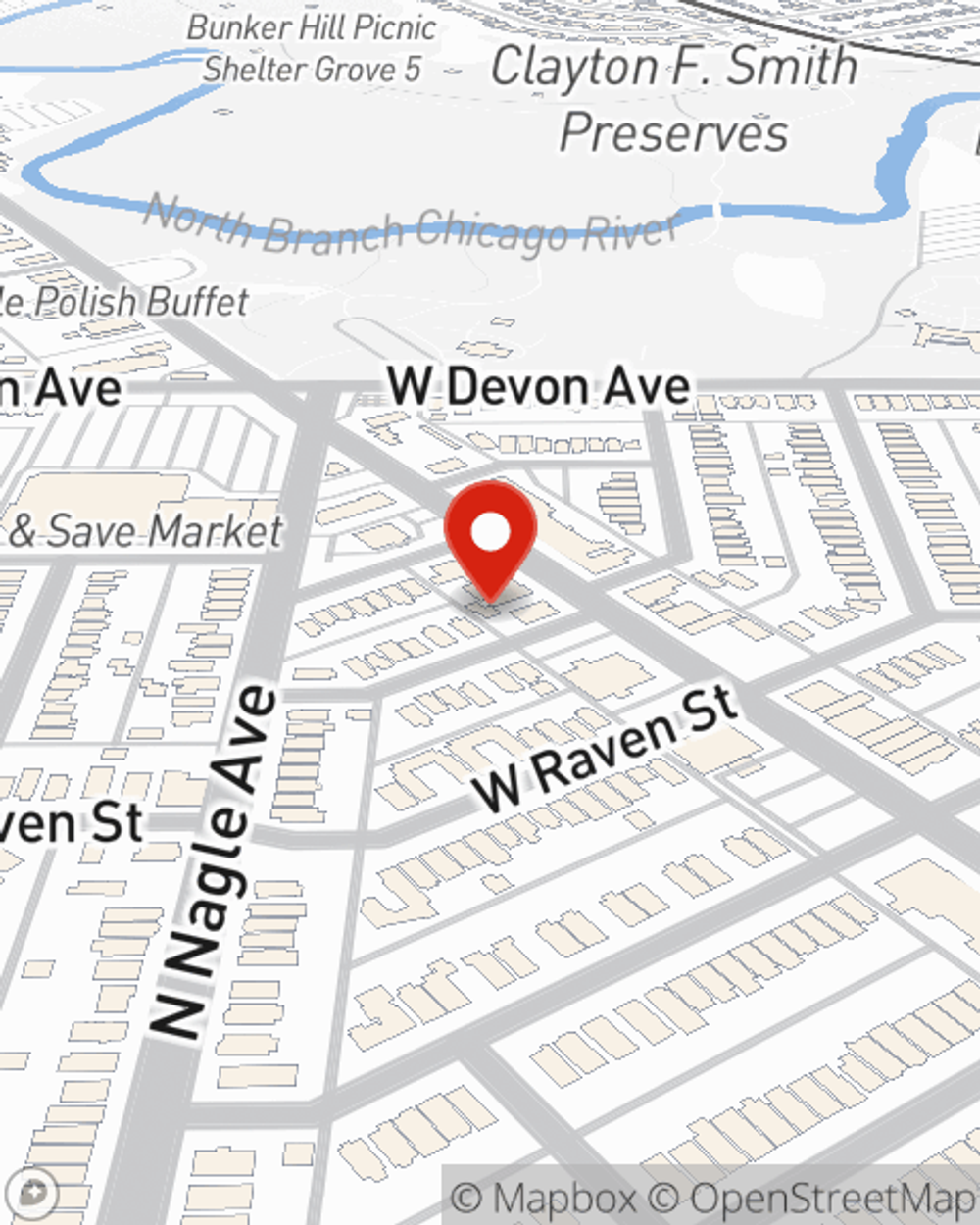

- Chicago

- Norwood Park

- Edison Park

- Edgebrook

- Sauganash

- Wisconsin

- Niles

- Morton Grove

- Glenview

- Jefferson Park

- Skokie

- Des Plaines

- Lincolnwood

Welcome Home, Condo Owners

When looking for the right condo, it's understandable to be focused on details like home layout and needed repairs, but it's also important to make sure that your condo is properly insured. That's where State Farm's Condo Unitowners Insurance comes in.

Chicago! Look no further for condo insurance

Protect your condo the smart way

Protect Your Condo With Insurance From State Farm

With this coverage from State Farm, you don't have to be afraid of the unanticipated happening to your unit and personal property inside. Agent Eric Bielinski can help lay out all the various options for you to consider, and will assist you in creating an excellent policy that's right for you.

Chicago condo owners, are you ready to explore what the State Farm brand can do for you? Visit State Farm Agent Eric Bielinski today.

Have More Questions About Condo Unitowners Insurance?

Call Eric at (773) 775-2000 or visit our FAQ page.

Simple Insights®

How to get rid of bed bugs

How to get rid of bed bugs

Learn about potential ways to spot bed bugs and what you can do to get rid of them before they spread throughout your home.

10 Washing machine maintenance tips

10 Washing machine maintenance tips

Routine washer maintenance can help reduce breakdowns and costly water damage. Learn how to clean your washing machine and more.

Eric Bielinski

State Farm® Insurance AgentSimple Insights®

How to get rid of bed bugs

How to get rid of bed bugs

Learn about potential ways to spot bed bugs and what you can do to get rid of them before they spread throughout your home.

10 Washing machine maintenance tips

10 Washing machine maintenance tips

Routine washer maintenance can help reduce breakdowns and costly water damage. Learn how to clean your washing machine and more.